Expanded instant asset write-off ends in weeks

Flor- Hanly - Monday, May 11, 2020

Instant asset write-off for eligible businesses

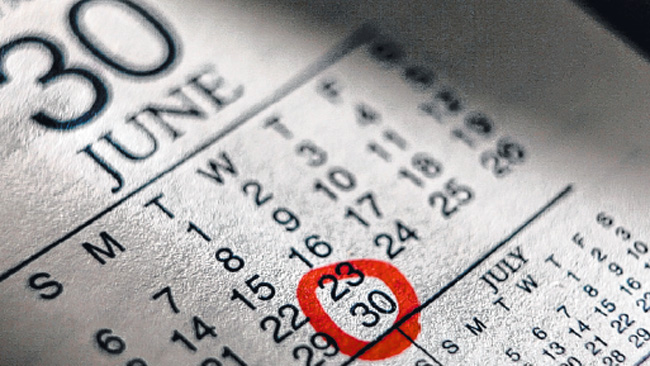

Small to medium-sized businesses are being reminded they have just weeks left to make the most of the government’s increased instant asset write-off offer.

Under instant asset write-off eligible businesses can:

Under instant asset write-off eligible businesses can:- immediately write off the cost of each asset that costs less than the threshold

- claim a tax deduction for the business portion of the purchase cost in the year the asset is first used or installed ready for use.

- Instant asset write-off can be used for both new and second-hand assets. Some exclusions and limits apply.

Changes from 12 March 2020

From 12 March 2020 until 30 June 2020 the instant asset write-off:- threshold amount for each asset is $150,000 (up from $30,000)

- eligibility has been expanded to cover businesses with an aggregated turnover of less than $500 million (up from $50 million).

Connect with us whatever way you like!

Facebook

LinkedIn

Email