2020 Federal Budget explained

2020/21 Federal Budget handed down on 6 October 2020 was certainly a reflection of the year it has been

Usually handed down in May each year it was delayed by the Federal Government this year due to COVID. There were also a few unexpected surprises announced by the Treasurer within the budget - many of which will be well received by a number of taxpayers. The key announcements affecting individuals and small and medium business are summarised below.

Instant Assets Write-Off for Small Businesses

Businesses are now able to deduct the full cost of capital assets purchased and ready for use from 6 October 2020 to 30 June 2022. This overrides the $150,000 instant asset write-off threshold that was previously in place to 31 December 2020. The new instant asset write-off applies to new depreciating assets as well as second-hand assets (for small and medium businesses) and is available for businesses with an aggregated annual turnover of less than $5 billion. This announcement also meant that small businesses (with a turnover of less than $10M) are be able to deduct the balance of their Small Business Depreciation Pool in full during the 2020/21 financial year.

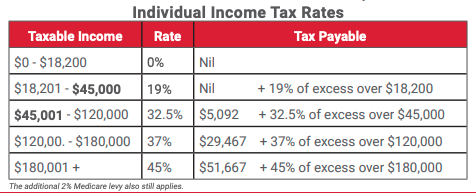

Individual Income Tax Rates

The government announced it would bring forward the previously announced reductions in individual income tax rates to 1 July 2020. For the new tax rates for the current 2020/21 financial year, see the table below:

Company Loss Carry-Back

Eligible companies are able to elect to “carry-back” tax losses from the 2019/20, 2020/21 or 2021/22 financial years to be offset against profit that was previously taxed in the 2018/19 or later income years. This measure is designed to assist companies that were profitable and paid tax for the 2018/19 financial year and then incurred a tax loss to receive a refundable tax offset. The election is first available to companies when lodging their 2020/21 income tax returns. Therefore, it will not be until the end of this financial year that companies will be able to receive the economic benefit of this budget announcement.

JobMaker Hiring Credit

The JobMaker Hiring Credit is available to eligible employers for 12 months for each additional new job they create for eligible employees until 6 October 2021. Eligible employees are those who have worked for at least 20 hours per week on average, are employed by your business between 7 October 2020 and 6 October 2021 and are within the relevant age groups and have received the JobSeeker, Youth Allowance or Parenting Payment for at least one month within the past three months before they were hired by your business.

The JobMaker Hiring Credit available to eligible employers is:

- $200 a week for each additional eligible employee hired that is aged 16 to 29 years old

- $100 a week for each additional eligible employee hired that is aged 30 to 35 years old

The JobMaker Hiring Credit requires the employee to be an “additional employee” of your business (ie. the business’ total employee headcount increases). Registrations for the JobMaker Hiring Credit and claims will be able to be processed with the ATO from 1 February 2021.

Tamika Layt is Flor-Hanly’s walking tax encyclopaedia! From capital gains tax to fringe benefits tax, and everything in between, Tamika’s strong tax advisory background also includes company restructures and rollovers, discretionary and family trusts and several other areas affecting small, medium and large businesses and family groups. She has a passion for helping her clients achieve their goals and being part of both their business and family journey. Call us in Mackay on 07 4963 4800.

Connect with us whatever way you like!

Facebook

LinkedIn

Email